CHIEF’s designated bank deposit accounts

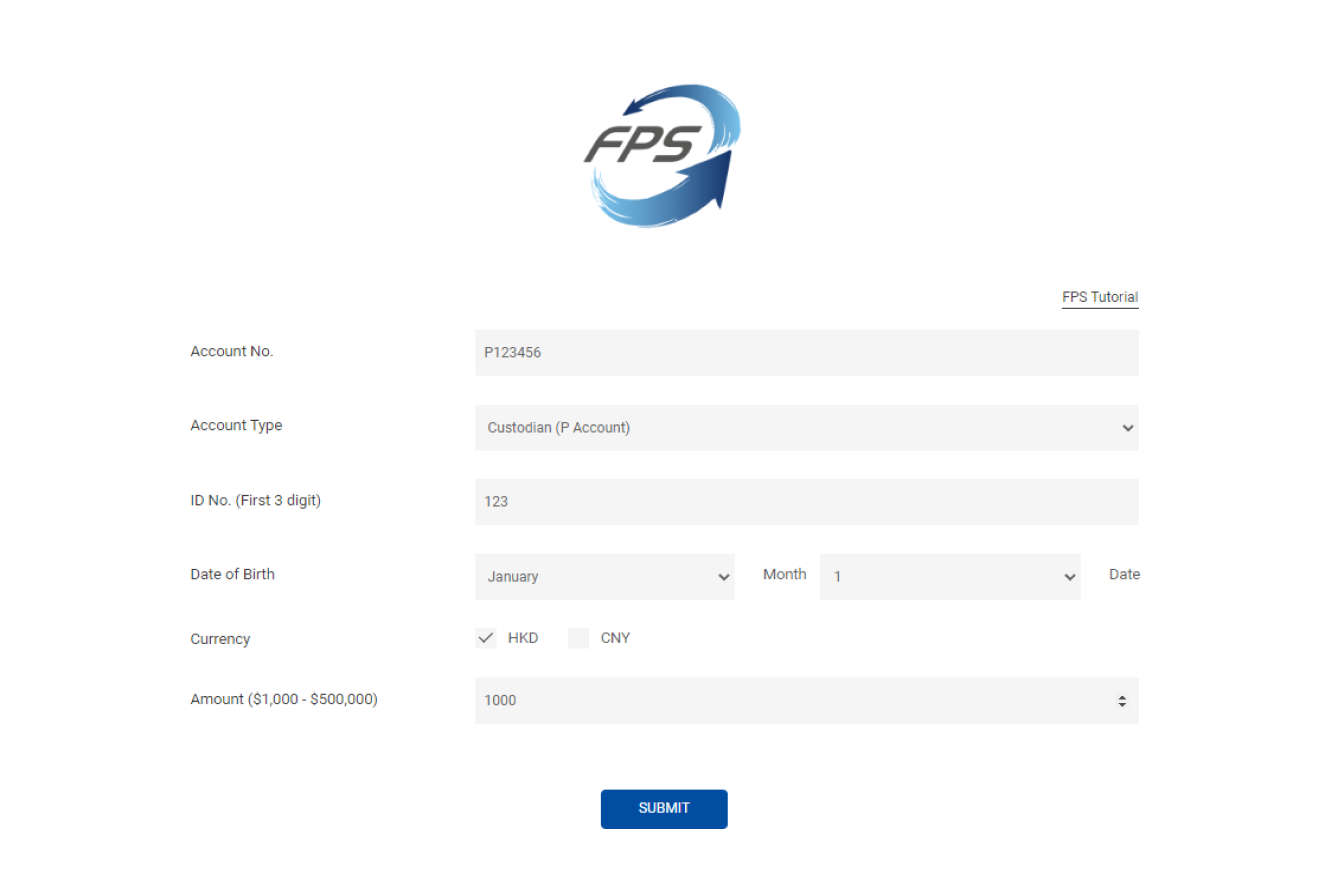

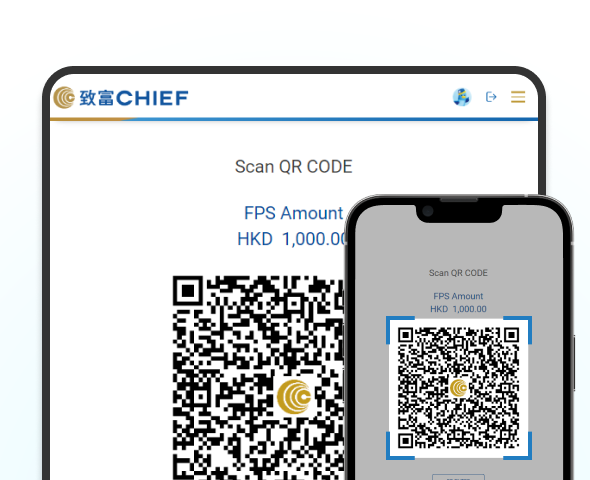

FPS

|

FPS ID

|

8785271

|

|

Email

|

cs@chiefgroup.com.hk

|

CHIEF's Bank Accounts

Chief Securities Limited

Chief Commodities Limited

|

Cut-offs Before 17:00 each trading day |

Deposit Account Hong Kong Stock / Global Stock / Stock Option Account |

* Please note that making transfers between local banks, you may be charged a handling fee by the beneficiary bank.

| HKD | Multi-Currencies | |

|---|---|---|

|

HSBC

|

400-273900-292

|

741-033393-838

|

|

Hang Seng Bank

|

383-017175-668

|

239-560576-883

|

|

Bank of China (HK)

|

070-932-1-001950-0

|

012-875-9-244782-6

|

|

Chong Hing Bank

|

256-10-266611-2

* Stock Option Cut-offs: Before 15:45 each trading day |

|

Cut-offs Before 16:30 each trading day |

Deposit Account Hong Kong Futures / Global Futures Account |

* Please note that making transfers between local banks, you may be charged a handling fee by the beneficiary bank.

| HKD | Multi-Currencies | |

|---|---|---|

|

HSBC

|

600-638282-002

|

502-693450-201

(USD)

|

|

848-201349-209

(RMB)

|

||

|

808-169734-275

(EUR)

|

||

|

808-169734-278

(JPY)

|

||

|

808-169734-276

(GBP)

|

||

|

Bank of China (HK)

|

012-875-0-040383-4

|

012-875-0-801657-3

(USD)

|

|

012-875-0-602238-5

(RMB)

|

||

|

012-875-9-240576-1

(USD / EUR / JPY / GBP)

|